All Categories

Featured

Table of Contents

- – How do I optimize my cash flow with Whole Life...

- – How flexible is Self-banking System compared t...

- – How do I track my growth with Private Banking...

- – What is the best way to integrate Wealth Buil...

- – How does Self-banking System compare to trad...

- – What is the long-term impact of Cash Value L...

- – Can I use Infinite Banking for my business f...

Term life is the best option to a short-lived requirement for safeguarding versus the loss of an income producer. There are far less factors for permanent life insurance policy. Key-man insurance and as part of a buy-sell arrangement entered your mind as a possible great factor to purchase an irreversible life insurance coverage policy.

It is a fancy term coined to sell high valued life insurance policy with sufficient compensations to the representative and large revenues to the insurance provider. Infinite Banking. You can reach the exact same result as boundless financial with far better results, more liquidity, no threat of a policy gap triggering an enormous tax problem and even more choices if you use my choices

How do I optimize my cash flow with Whole Life For Infinite Banking?

My prejudice is good information so returned here and check out even more write-ups. Contrast that to the biases the marketers of infinity financial get. Below is the video from the marketer used in this short article. 5 Blunders People Make With Infinite Banking.

As you approach your golden years, monetary protection is a top priority. Among the lots of various economic techniques out there, you may be hearing a growing number of concerning limitless financial. Infinite Banking wealth strategy. This concept allows nearly anyone to become their very own lenders, providing some benefits and flexibility that could fit well right into your retirement strategy

How flexible is Self-banking System compared to traditional banking?

The car loan will accumulate basic passion, yet you maintain adaptability in establishing repayment terms. The rate of interest is also traditionally reduced than what you would certainly pay a conventional financial institution. This sort of withdrawal allows you to access a part of your cash money worth (as much as the amount you've paid in premiums) tax-free.

Numerous pre-retirees have problems regarding the security of limitless banking, and for great factor. The returns on the cash money value of the insurance coverage policies might rise and fall depending on what the market is doing.

How do I track my growth with Private Banking Strategies?

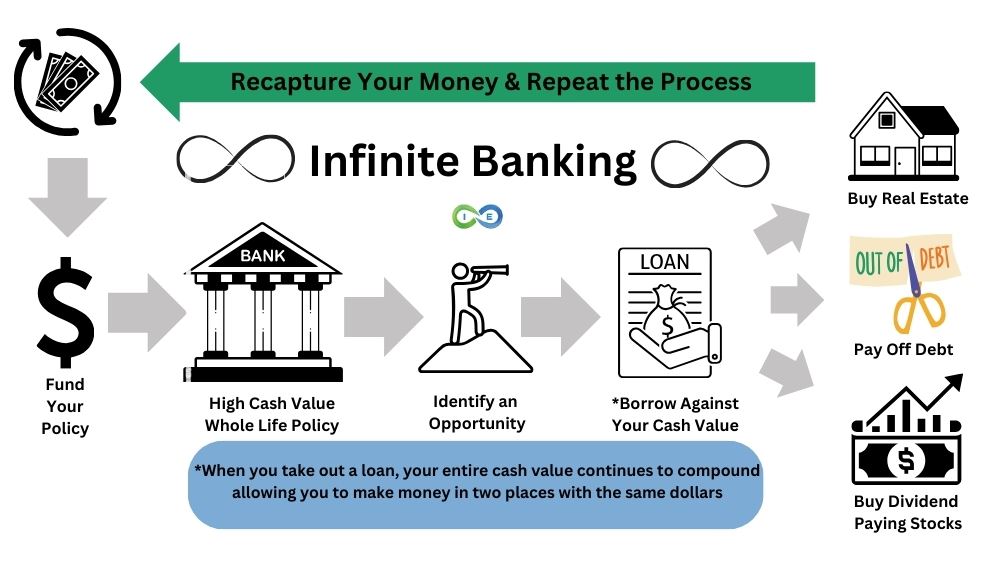

Infinite Banking is an economic method that has actually gained significant interest over the past couple of years. It's an one-of-a-kind method to taking care of individual finances, allowing individuals to take control of their money and produce a self-sufficient banking system - Cash flow banking. Infinite Financial, additionally called the Infinite Financial Principle (IBC) or the Rely on Yourself method, is an economic method that includes utilizing dividend-paying entire life insurance policy plans to create an individual financial system

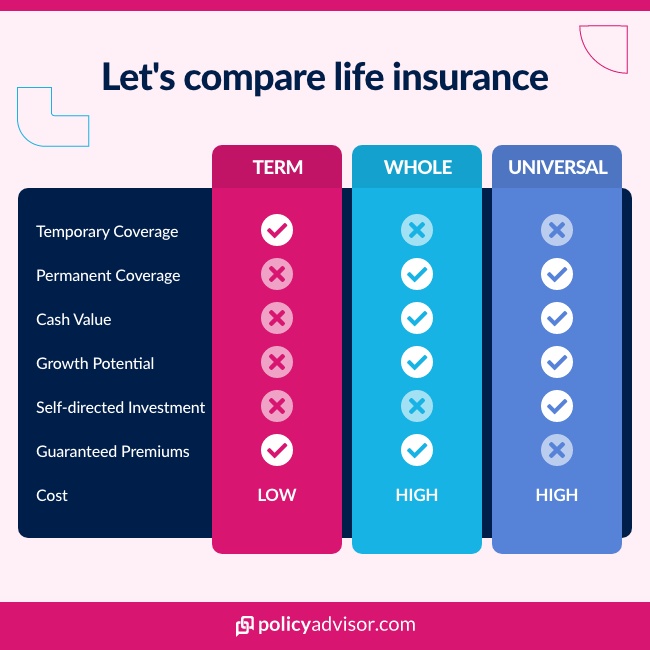

To comprehend the Infinite Financial. Concept strategy, it is for that reason vital to give a review on life insurance policy as it is a really misconstrued possession course. Life insurance is a crucial component of monetary preparation that provides lots of advantages. It can be found in many forms and dimensions, the most typical types being term life, entire life, and universal life insurance policy.

What is the best way to integrate Wealth Building With Infinite Banking into my retirement strategy?

Term life insurance, as its name recommends, covers a specific duration or term, commonly in between 10 to 30 years. It is the simplest and frequently the most affordable type of life insurance.

Some term life plans can be restored or exchanged a long-term policy at the end of the term, but the premiums usually raise upon renewal because of age. Whole life insurance is a kind of long-term life insurance policy that offers protection for the insurance holder's entire life. Unlike term life insurance coverage, it includes a cash value part that expands gradually on a tax-deferred basis.

It's crucial to keep in mind that any type of outstanding car loans taken versus the plan will reduce the fatality benefit. Entire life insurance is commonly much more expensive than term insurance policy because it lasts a life time and builds money worth. It also offers foreseeable costs, suggesting the cost will not raise over time, providing a level of certainty for insurance policy holders.

How does Self-banking System compare to traditional investment strategies?

Some reasons for the misconceptions are: Intricacy: Entire life insurance policy policies have much more intricate features compared to label life insurance, such as cash money worth build-up, rewards, and policy fundings. These attributes can be challenging to comprehend for those without a background in insurance policy or individual financing, bring about confusion and mistaken beliefs.

Prejudice and false information: Some people may have had adverse experiences with whole life insurance policy or heard stories from others who have. These experiences and anecdotal info can add to a prejudiced view of entire life insurance policy and perpetuate misunderstandings. The Infinite Financial Concept method can only be carried out and implemented with a dividend-paying entire life insurance policy plan with a common insurance business.

Whole life insurance policy is a kind of permanent life insurance that offers coverage for the insured's whole life as long as the premiums are paid. Whole life plans have two primary elements: a death benefit and a money value (Financial independence through Infinite Banking). The survivor benefit is the amount paid to beneficiaries upon the insured's fatality, while the money worth is a savings component that grows with time

What is the long-term impact of Cash Value Leveraging on my financial plan?

Returns repayments: Mutual insurance companies are possessed by their insurance policy holders, and as an outcome, they may disperse revenues to insurance policy holders in the type of dividends. While rewards are not ensured, they can aid boost the money worth growth of your plan, increasing the total return on your funding. Tax advantages: The cash value growth within a whole life insurance policy plan is tax-deferred, meaning you do not pay tax obligations on the development until you withdraw the funds.

Liquidity: The money worth of an entire life insurance policy is extremely fluid, allowing you to access funds conveniently when needed. Asset security: In lots of states, the cash worth of a life insurance coverage policy is shielded from lenders and legal actions.

Can I use Infinite Banking for my business finances?

The policy will certainly have prompt cash money value that can be positioned as collateral thirty days after moneying the life insurance policy plan for a rotating credit line. You will certainly be able to accessibility with the rotating line of credit approximately 95% of the readily available money value and make use of the liquidity to money an investment that supplies income (cash money flow), tax obligation advantages, the chance for admiration and leverage of other individuals's ability, capabilities, networks, and resources.

Infinite Financial has come to be really popular in the insurance world - also extra so over the last 5 years. R. Nelson Nash was the maker of Infinite Financial and the organization he established, The Nelson Nash Institute, is the only organization that officially authorizes insurance policy agents as "," based on the following standards: They line up with the NNI standards of expertise and principles (Wealth building with Infinite Banking).

They effectively complete an apprenticeship with an elderly Authorized IBC Specialist to ensure their understanding and capability to apply every one of the above. StackedLife is Licensed IBC in the San Francisco Bay Area and functions nation-wide, aiding customers understand and apply The IBC.

Table of Contents

- – How do I optimize my cash flow with Whole Life...

- – How flexible is Self-banking System compared t...

- – How do I track my growth with Private Banking...

- – What is the best way to integrate Wealth Buil...

- – How does Self-banking System compare to trad...

- – What is the long-term impact of Cash Value L...

- – Can I use Infinite Banking for my business f...

Latest Posts

Banker Life Quotes

Start Your Own Personal Bank

Ibc Finance

More

Latest Posts

Banker Life Quotes

Start Your Own Personal Bank

Ibc Finance